On January 20, iQIYI International's 2025 Global Content Hit List was officially released. Combining market reference value with industry guidance, the list reveals a phase shift in the global expansion of Chinese-language content: in 2025, total viewership on iQIYI International grew by 114.5% year on year, with Chinese-language content emerging as the platform's core growth engine. This signals that Chinese-language content has moved beyond "isolated trials" and officially entered a new stage of systematic overseas expansion. Meanwhile, the DataEye Research Institute released the 2025 Overseas Micro Drama Data Report, further enriching the understanding of key trends and data dynamics in the global micro drama market.

In recent years, China's micro drama industry has experienced explosive growth, with the market size surpassing the trillion-yuan threshold—nearly double China's total box office revenue—far exceeding earlier expectations. The industry has gradually transitioned from a phase of rapid expansion to one characterized by intensified competition within a mature market.

As an emerging force in the global expansion of Chinese-language content, micro dramas, leveraging their advantages of lightweight production, strong adaptability, and low costs, are forming a synergistic ecosystem with traditional Chinese-language content formats such as television dramas, animation, and films. Together, they are driving China's cultural exports into a new stage marked by diversification, higher quality, and more practical, execution-oriented global engagement.

iQIYI International's 2025 Global Content Hit List

Systematic Global Expansion Finally Taking Shape

Relying on the deep overseas expansion of Chinese streaming platforms such as iQIYI International, Chinese-language content has completely overcome the previous limitations of "single-point breakthroughs and scattered exports," forming a systematic global expansion model that integrates multiple categories, including "dramas, animation, and films," with a full industry chain approach.

Core data from the iQIYI International's 2025 Global Content Hit List reveals that the urban romance drama The Best Thing, which integrates "Traditional Chinese Medicine culture" with an innovative narrative featuring "medicinal cuisine as love language and acupuncture for healing hearts," topped the drama category, breaking the traditional perceptions of overseas audiences about Chinese-language dramas.

The fantasy epic Lingwu Continent led the animation category, with other domestic animation works such as The Lone Sword Overlord and Peerless Battle Soul also ranking high, showcasing the strong export potential of Chinese animation.

Meanwhile, the enduring appeal of classic cultural IPs continues to shine through, as Nezha-themed films such as Nezha: Birth of the Demon Child, Nezha: The Demon Child Returns, and Nezha: Wrath of the Sea swept the top three positions in the Chinese-language film rankings, validating the global adaptability of Chinese traditional cultural IP.

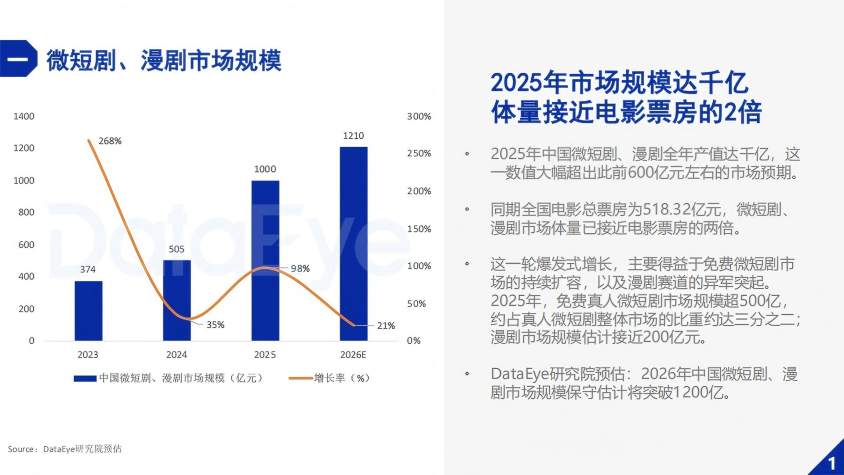

2025 Micro Drama and Animation Drama Market Scale (Source: DataEye Research Institute Report)

According to DataEye Research Institute data, the Chinese micro drama and animation drama industries will experience explosive growth in 2025, with core data highlighting the industry's potential. The market size is expected to reach the trillion-yuan level, nearly double that of the total box office revenue of the entire country, with the industry transitioning from its explosive growth phase to a phase of inventory competition. This growth is primarily driven by the continued expansion of the free micro drama market and the rise of animation dramas as a new force. Among them, the free live-action micro drama market will exceed 50 billion yuan, accounting for two-thirds of the total live-action micro drama market, while the animation drama market will approach 20 billion yuan. The overall market size is expected to exceed 120 billion yuan by 2026.

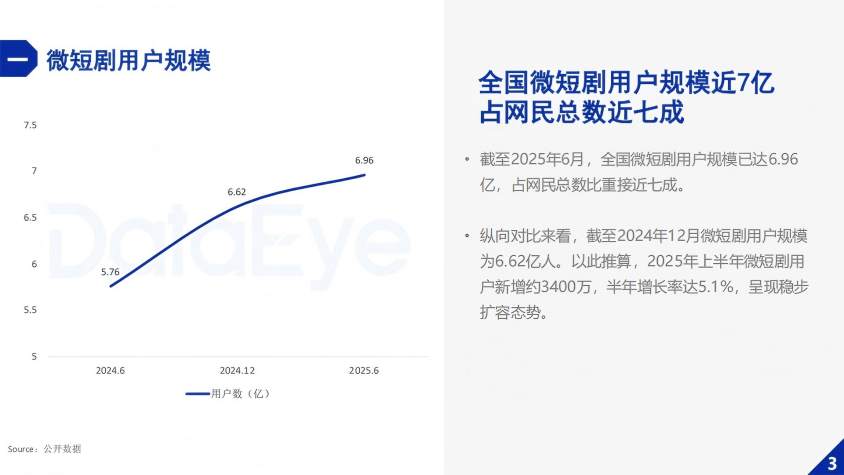

2025 Micro Drama User Scale (Source: DataEye Research Institute Report)

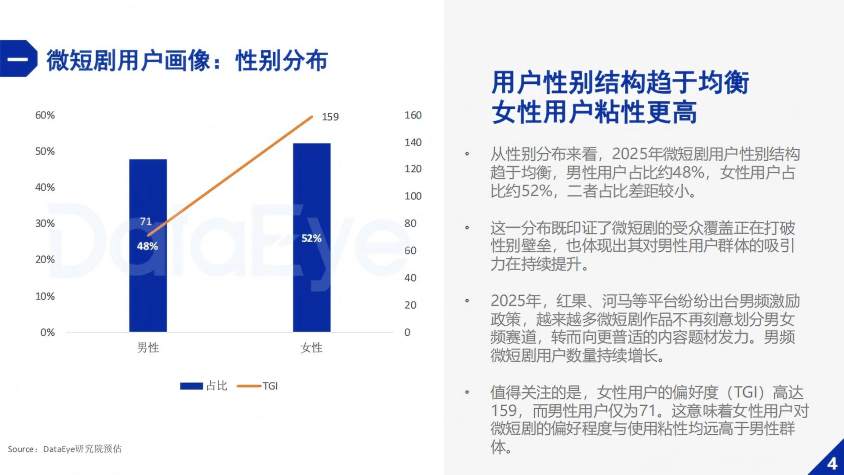

In terms of user scale, as of June 2025, the number of micro drama users nationwide reached 696 million, accounting for nearly 70% of total internet users. In the first half of the year alone, the user base increased by 34 million, maintaining steady growth momentum. User profiles display distinct characteristics: gender distribution has become increasingly balanced, with female users accounting for 52%, while their preference intensity and user retention significantly surpass those of male users. The age structure continues to skew younger, with more than 60% of users under the age of 40. Users aged 19 and below demonstrate the highest level of engagement, while consumption interest among middle-aged users has also been successfully activated. The explosive growth of the domestic micro drama market has provided abundant content supply, mature operational models, and robust technological support for overseas expansion, simultaneously accelerating the global rollout of Chinese micro dramas.

2025 Micro Drama User Profile (Source: DataEye Research Institute Report)

From a global perspective, the overseas micro drama market reached a scale of USD 4 billion in 2025. Combined in-app purchase revenue across mobile platforms totaled USD 2.279 billion, with 1.855 billion downloads, representing year-on-year growth of 129% and over 300%, respectively. Among these figures, Chinese micro drama apps expanding overseas generated approximately USD 2.163 billion in in-app purchase revenue and 1.493 billion downloads, accounting for 94.93% of total revenue and 80.46% of total downloads—underscoring China's dominant position in the global micro drama market.

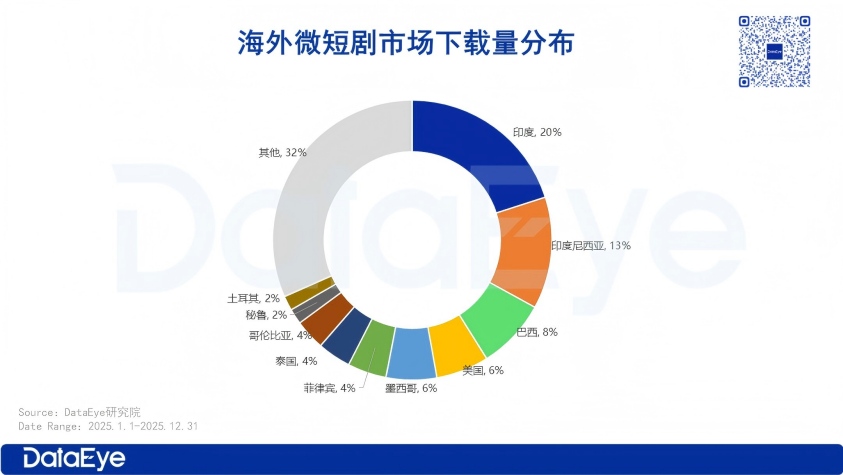

Regionally, developed markets such as Europe, North America, Japan, and South Korea serve as the primary revenue drivers, collectively contributing over 60% of total revenue, with the United States, Japan, and the United Kingdom ranking as the top three revenue markets. In contrast, India, Indonesia, and Brazil are the core download markets, together accounting for more than 40% of total downloads. Notably, driven by the rapid expansion of local developers, India has surged to the top of the global download rankings.

Overseas Micro Drama Market Download Distribution (Source: DataEye Research Institute Report)

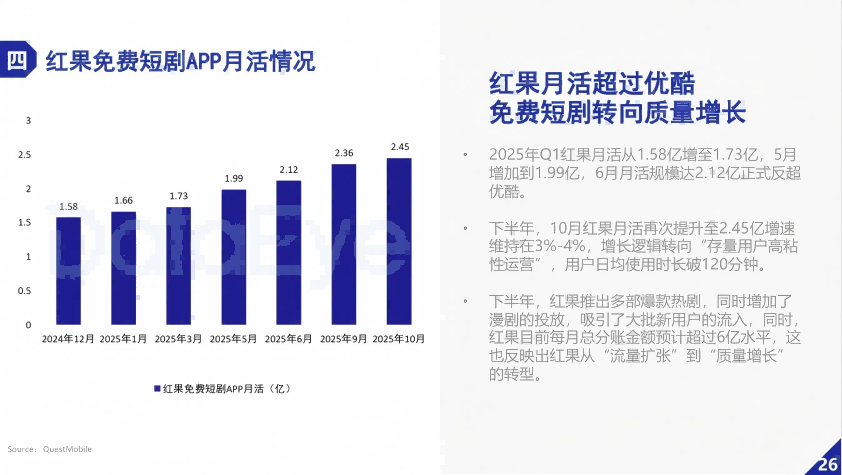

Platforms such as DramaWave, Hongguo Short Drama, ReelShort, and DramaBox have shown outstanding performance. Among them, Hongguo Short Drama, as a leading domestic micro drama platform, has surpassed Youku in terms of monthly active users. The user base primarily consists of young women, with over 70% of users under the age of 40. Its premium and serialized operation model is directly replicable for overseas expansion. ReelShort, with an estimated revenue of USD 432 million, leads the overseas micro drama app revenue rankings, while DramaBox, with an estimated 2.28 billion downloads, tops the download chart, making it a benchmark case for micro drama expansion abroad.

Additionally, according to media reports on February 2, the number of Chinese micro drama apps overseas has surpassed 300, with Chinese-developed products dominating the global short drama app download rankings, further confirming the strong momentum of Chinese micro dramas going global.

Hongguo Short Drama App Monthly Active Users (Source: DataEye Research Institute Report)

With the continued deepening of Chinese streaming platforms' overseas presence, the distribution channels for Chinese content have fundamentally evolved, breaking free from reliance on traditional overseas TV stations and international streaming platforms. This marks the official entry into a new phase of "building ships for overseas expansion," providing solid channel support for micro dramas across the entire industry chain. According to the report "Research on Enhancing the Overseas Influence of Chinese TV Dramas," Chinese streaming platforms' international versions have become a key destination for overseas audiences seeking Chinese TV dramas. Among them, iQIYI International has a strong presence in Southeast Asia, where it has a large core audience. WeTV and Youku have gradually expanded to Europe and Oceania, where they have established stable user bases.

At the same time, the distribution channels are becoming increasingly diversified and multi-dimensional: platforms such as YouTube and TikTok have become important avenues for overseas audiences to access Chinese content. In particular, in regions like Oceania and Russian-speaking areas, short video platforms are the most frequently used channels for watching content. Douyin's native micro dramas have performed remarkably well, with annual viewership surging and monthly growth peaks exceeding 2.1 billion. More than 200,000 micro dramas are currently streaming, with 90% of them being new productions. The number of billion-view dramas continues to grow, providing a mature channel reference for micro dramas going global. Additionally, the comment sections of Chinese micro dramas on TikTok have become a "small plaza" for cross-cultural exchange.

Moreover, iQIYI International and other platforms have partnered deeply with local overseas partners such as Astro (Malaysia), Etisalat (UAE), and Indonesian Telecom to offer "traffic + content" bundled services, further expanding distribution channels and boosting the exposure and influence of Chinese content in local markets. This creates a "multi-platform distribution matrix" with long-form video platforms, short-video platforms, and local partners, which supports the full industry chain of micro dramas going abroad.

iQIYI Forms Strategic Cooperation with Malaysia's Leading Media Brand Astro (Source: Global Network)

"Content Diversification, Regional Differentiation, and Genre Focus"

Whether traditional Chinese content or micro dramas, the process of going global has shown core features of "content diversification, regional differentiation, and genre focus," which cater to the operational needs of different overseas markets.

In the realm of traditional Chinese content, overseas audiences in different regions exhibit distinct consumption preferences: East Asian audiences are more inclined toward mystery content, with series like The Chronicle of Snow and No Worries Crossing that integrate detective elements performing well; the Middle East and North Africa (MENA) region prefers military-themed content, with shows like Flame Battalion and Falling for Special Forces being widely praised; in North America, Chinese animations dominate the non-drama content rankings, with the action-fantasy animation Super Cube: Extraordinary Edition ranked first. DramaWave, in Southeast Asia, launched The Ghost's Bride, which blends Thai horror and romance elements, and in Latin America, it released The Dangerous Lovers, which combines magical realism, accurately matching the cultural preferences of different regions.

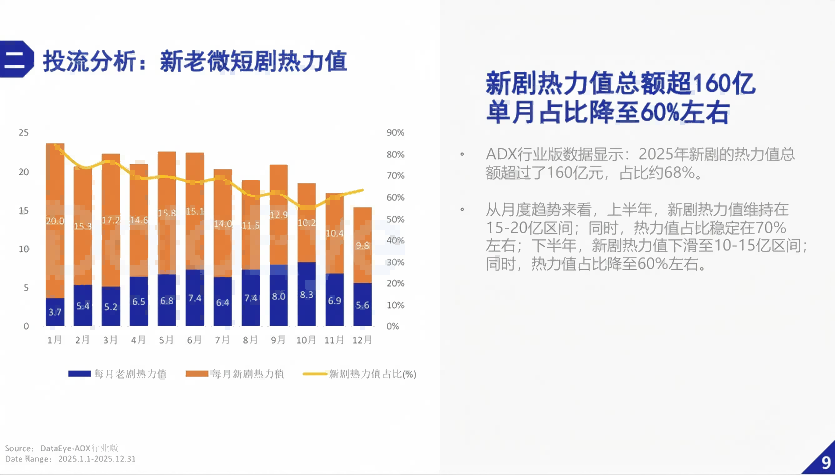

In addition, the domestic micro drama industry has a robust production capacity, with over 190,000 short dramas produced by 2025, over 80% of which are new dramas. However, there is a clear distribution of popularity, with more than half of the works having low popularity (under 1 million views), while the top 100 dramas contribute 14.56% of the total heat value. This characteristic extends to overseas markets, with premium content being the key to breakthrough in micro drama exports.

New and Old Micro Drama Investment Flow Analysis (Source: DataEye Research Institute Report)

Localization operations have become the core competitive advantage for Chinese content going global. The process has evolved from basic "dubbing and subtitle translation" to "content + business + operations" deep localization. Some leading cases have achieved a "China-controlled + overseas co-creation" advanced model, aligning with industry operational needs.

In the traditional Chinese content domain, platforms such as iQIYI International have developed their proprietary "Qisheng Film and TV Intelligent Dubbing System" which converts and synthesizes voices in multiple languages like Chinese, English, Thai, and Vietnamese. The AI voice library includes nearly 100 different voice styles, allowing precise matching with the storyline's emotional tone and catering to the auditory preferences of different regional audiences. Data indicates that in Thailand, eight out of the top ten drama series are Chinese shows dubbed in Thai, highlighting the importance of localized dubbing.

Even more noteworthy is the emergence of the "China-controlled, overseas-produced" deep co-creation model for Chinese content going global. A typical example of this is the Thai adaptation of The Thirsty 30, where local elements were fully integrated into character settings, plot development, and dramatic conflicts. This adaptation successfully combines China's mature creative concepts and industrial standards with overseas creative inspirations, achieving dual empowerment for both "going global" and "localizing" content. This provides the industry with a replicable operational model.

Poster for The Thirsty 30

Technological Empowerment and Efficiency Improvement, Free Model Becomes Mainstream

The application of cutting-edge technologies, such as AI, has become a core driver of the upgrading of the micro drama and Chinese content export industry. These technologies cover the entire industry chain, including content creation, translation adaptation, and operation promotion, effectively improving operational efficiency. Meanwhile, China's micro drama export market has shown a new trend of "full industry chain export," with continuous policy support and the free model becoming the mainstream in the domestic micro drama market. This has empowered the export process, highlighted the effect of leading players, and created a clear industry competition landscape.

AI technology has been comprehensively applied across the entire micro drama export chain. On the content creation side, AI script-generation tools significantly improve creative efficiency. Teams are able to use AI to analyze the preferences of overseas audiences in real time, as well as recommend local slang. DramaWave uses AI tools to launch 50 new films per week, far surpassing the industry average, effectively solving the problem of insufficient content supply for exports.

For translation and adaptation, AI enables translation into dozens of languages and context conversion. iQIYI's intelligent dubbing system not only facilitates multilingual conversion but also precisely matches the emotional tone of the storyline, improving dubbing quality. This technology addresses the issues of low efficiency, high costs, and poor adaptability often associated with traditional translation methods.

On the operation and promotion front, AI can analyze the entire drama in seconds, generating thousands of different promotional trailers with just one click. Currently, the total number of advertising materials for overseas micro dramas has reached 13.957 million, with AI applications drastically reducing promotional costs and increasing efficiency. AI has already achieved a 90% reduction in costs for promotional materials.

These technological advancements are playing a pivotal role in the growth of China's micro drama export market, allowing for efficient and cost-effective operations, improving quality, and enabling rapid expansion.

DramaWave Popular Advertisement Material with Localized Language Subtitles (Data source: Sensor Tower Retail Media Insights)

In the full industry chain export model, an innovative "Chinese IP + local production" approach has been formed. Chinese companies are not only exporting completed micro dramas but also providing mature storyboarding templates, production schedules, and operational systems to overseas markets. These companies have set up production centers abroad and collaborated with local teams of actors, photographers, and other professionals to complete the creative process, transforming from content export to ecosystem export.

On the policy side, various regions have tailored support measures to boost the export of micro dramas. For example, Zhengzhou in Henan has established a special industry fund and introduced high-value export creation subsidies, while Hangzhou in Zhejiang has developed a cultural export experimental zone offering comprehensive support throughout the process. Guangxi is focusing on the ASEAN market, developing a cross-border micro drama industry hub to accelerate the export of micro dramas.

In terms of commercial models, the domestic free model for micro-dramas has become mainstream, simultaneously empowering overseas markets. This has formed a mature closed-loop system with "free traffic acquisition + paid unlocking of core content + ad monetization." More than 60% of overseas free micro drama apps now operate on this model, with a primary focus on emerging markets like Southeast Asia and India. While IP derivative development still has room for improvement, it has become a key focus area in the industry. In the future, content can be further monetized through the development of derivative products such as games, trendy toys, and stage plays.

Distribution of Chinese Micro Drama Issuing Platforms (Data source: DataEye Research Institute)

As for the competitive landscape, there is a noticeable regional clustering effect in both the distribution and production sectors. Platforms are concentrated in Beijing, Zhejiang, Guangdong, while production entities in Shaanxi, Henan, and Zhejiang are particularly prominent. Leading platforms and production companies dominate with a high degree of market concentration. Notable platforms like ReelShort, DramaBox, and Red Fruit Short Drama have demonstrated strong performance. For instance, ReelShort leads the overseas micro-drama app revenue chart with an estimated revenue of $432 million, while DramaBox tops the download list with an estimated 228 million downloads. These top platforms excel by offering localized content, a mature paid model, and refined operations, achieving high download volumes and substantial revenue conversion.

Red Fruit Short Drama and other leading platforms have successfully transitioned from "scale growth" to "quality growth," with new dramas contributing over 60% of their heat. The holiday effect has also driven a concentrated release of new series, and the focus on serialized content and high-quality production has become the key to breaking through in terms of popularity. A small number of high-quality works now account for a large share of heat, and this model is gradually being extended to overseas markets.

Industry Outlook: Chinese Content Going Global

Currently, the micro drama and Chinese content export industry is facing unprecedented development opportunities. The trillion-yuan domestic micro drama market provides ample content supply, a mature operational model, and strong technical support for overseas expansion. The impressive results of the iQIYI International's 2025 Global Content Hit List confirm the global competitiveness of Chinese content, marking the initial formation of a systematized export structure for Chinese content. The explosive growth of the global micro drama market, especially the huge potential in emerging markets, provides a vast market space for the export of Chinese micro dramas. The continuous empowerment of advanced technologies like AI will further enhance industry operational efficiency and break down cultural and technological barriers.

Looking ahead, with the continued deepening of boutique production and localized operations, the comprehensive empowerment of free models, and the gradual overcoming of talent and technical gaps, micro dramas and traditional Chinese content will form a stronger synergistic effect, jointly promoting Chinese content export from "quantity growth" to "quality breakthrough." At the same time, industry competition may intensify further, with homogeneous works gradually being eliminated. Boutique production, serialization, and localization will become the mainstream development trends in the industry. IP derivative development will become a new growth driver, promoting the dual enhancement of commercial and cultural value in the industry.

However, the industry still faces many challenges. The intensifying competition in international markets, the presence of cultural barriers, and talent shortages are issues that require collective efforts from all industry players to resolve. Adhering to the development directions of boutique production, localization, and internationalization, based on practical industry needs, will help drive high-quality development for the micro-drama and Chinese content export industry. This will enable more high-quality Chinese content to reach the global stage, tell China's story, spread China's voice, and achieve a win-win situation for both sustainable industry development and cultural export. (Author / Li Sixuan, Editor / Cheng Yingzi)