As our fingers swipe endlessly across screens, glued to one- or two-minute episodes of so-called "electronic fast food," have we ever paused to consider where these addictive short dramas actually come from? Are they born of Hengdian's glamorous transformation—the "Hollywood of the East"—or driven by the rapid rise of new "vertical studios" in cities like Zhengzhou and Xi'an? Sparked by the vertical screen, a quiet industry revolution is underway, reshaping both the landscape and the future of China's film and television industry.

Hengdian's transformation from the "Hollywood of the East" into a "vertical-screen factory" is, at its core, a survival strategy shaped by structural shifts in the industry. In 2024, the market size of micro-short dramas surpassed 50 billion yuan for the first time, overtaking traditional box-office revenue and leaving Hengdian little choice but to ride this new wave. Data shows that in 2024, revenue at Hengdian World Studios grew 32% year on year, with micro-short drama productions accounting for 68% of location rental income, while demand from traditional film and television projects declined by 19.58%. This pivot toward a model in which both horizontal and vertical formats coexist is not a strategic flourish, but a pragmatic response compelled by market realities.

A scene from Hengdian World Studios

With nearly 30 years of accumulated "hard power," Hengdian offers unique support for micro-short dramas. By renovating areas such as Chinese Culture Park and the Song Street Filming Base, it has established nearly 1,000 dedicated micro-short drama sets, ranging from historical palaces to modern "CEO offices." A vast talent pool—over 140,000 extras and more than 15,000 supporting professionals—combined with specialized division of labor, has dramatically improved production efficiency. Policies such as Measures to Promote the High-Quality Development of the Micro-Short Drama Industry have been introduced, along with a vertical-screen drama operations center providing one-stop, end-to-end services.

Hengdian has also keenly seized the opportunity presented by the overseas expansion of China's "new cultural trio." By the first quarter of 2025, Chinese companies had launched 237 overseas short-drama apps, with global cumulative downloads exceeding 270 million. Hengdian has developed overseas-style sets such as European towns and Sakura Retreats, established the Hengdian International Short Drama Alliance, and built a full support system from creation to overseas distribution. In the first three quarters of 2025 alone, nearly 1,000 dedicated micro-short drama sets were completed. Of the 4,016 vertical-screen drama crews received, about 10% were for overseas distribution—successfully upgrading Hengdian from a"production base" to an "innovation hub."

Facing the trend toward premium short dramas, Hengdian invested 120 million yuan to upgrade its digital studios, introduced XR virtual production technologies, and partnered with the China Research Institute of Film Science & Technology to achieve breakthroughs in digital audio rendering. Virtual production has significantly reduced per-episode costs, while "cloud scouting" applications allow crews to pre-screen over 60% of locations without leaving their offices, greatly boosting efficiency.

A Multipolar Rise: "Vertical Studios" Bloom Nationwide, Reshaping the Landscape

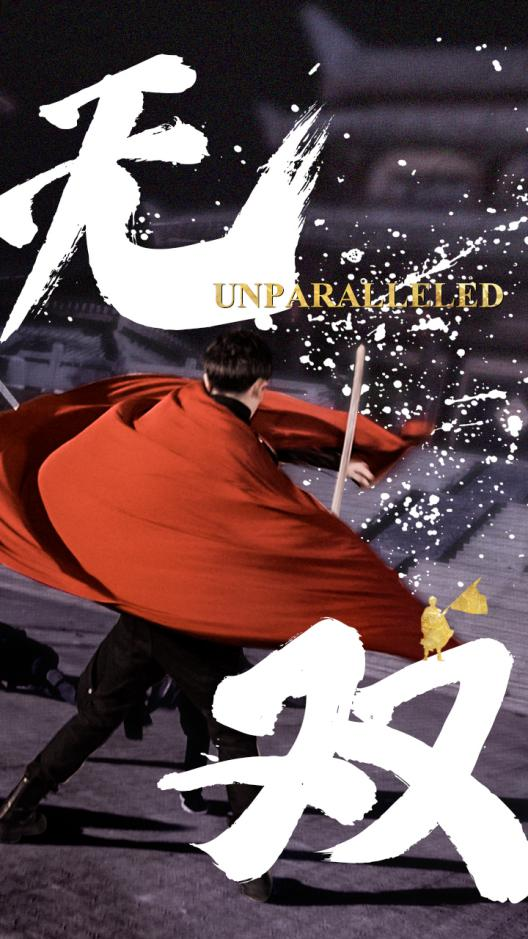

By now, across China, multiple short-drama bases characterized by cost advantages, industrial clusters, and policy support have emerged, creating a "hundred flowers blooming" pattern. The first tier consists of cost-control players. Zhengzhou, leveraging the industrial foundation of "Lighting Village," low-cost sets converted from idle shopping malls, and an efficient "10-minute ecosystem," launches over 100 productions daily. Its comprehensive costs are 10–20% lower than Hengdian's. In 2024, the city hosted more than 820 micro-short drama production companies, with a market size of 2.3 billion yuan. Xi'an, relying on its pool of "fragmented drama actors," university talent reserves, and the blockbuster effect of Unparalleled—which surpassed 100 million yuan in in-app purchases within eight days of release—has become a powerhouse: around 60 of every 100 micro-short dramas nationwide are produced there, with production heat ranking among the highest in the country.

The next tier features differentiated, specialty players. Linping in Hangzhou is building a "615" industrial system through its "Second Ascent" plan, creating the "Linying Film Studio" and focusing on integrated models such as "micro-short dramas + cultural tourism" and "micro-short dramas + advanced manufacturing." Tongguan in Hunan, branding itself as a "vertical studio," is building a central China short-drama ecosystem rooted in its millennium-old kiln culture, exploring a path from fast consumption to premium content. Haimen in Nantong has invested in the Jian Gong Lake Filming Base and Dongbuzhou Micro-Short Drama Base, laying out an integrated "film & TV + technology + tourism" ecosystem. Another tier consists of regional complementary players. Zhuozhou in Baoding City, benefiting from the Beijing-Tianjin-Hebei integration strategy, absorbs Beijing's industry spillover while attracting crews with low-cost accommodation and abundant outdoor locations. Jiading in Shanghai has built over 8,000 square meters of historical sets to fill the city's Han-Tang style gap, developing "one-day studio tour" cultural tourism experiences.

Zhengzhou Xigang Short Drama Film City

Who Is the Real "Hengdian"? A Contest Between Scale and Ecosystem

Zhengzhou's "scale-driven" path shows the greatest potential. Its industrial cluster effect is strong, forming a complete chain from scriptwriting and shooting to production, distribution, and traffic acquisition. Bases such as Jumei Film Studio and Dazhi Film and Television Base host over 20 crews daily. Policy support is unprecedented: the Zhengzhou Action Plan for Building a "Micro-Short Drama Creation Capital" requires each district or county to cultivate at least one filming base exceeding 5,000 square meters. Its cost advantage is hard to replicate—converted shopping malls and furniture markets offer rents far below professional studios, while Xuchang's "Lighting Village" supplies 80% of the nation's lighting technicians. The employment impact is also notable: micro-short dramas have created about 647,000 jobs, attracting opera performers, college students, and other groups.

Poster of short drama Unparalleled, produced in Xi'an

However, the true "next Hengdian" may not be a single city, but a diversified ecosystem. Hengdian itself is evolving—from a filming base to an innovation center—by building the Hengdian International Film & TV Cultural Innovation Hub and strengthening applications of AI and virtual production. Industrial division of labor will become more refined: Beijing leads in platforms and IP resources (accounting for two-thirds of national output value), Shenzhen becomes the hub for overseas expansion, Hangzhou excels at "micro-short dramas + tourism," while Zhengzhou and Xi'an specialize in large-scale production. Technology will reshape competition, as AI scriptwriting, virtual production, and traffic algorithms may give rise to a new generation of "digital short-drama bases."

Industry Evolution: From Wild Growth to Ecosystem Competition and Global Expansion

The short-drama industry is undergoing three major shifts. First, from "traffic-driven" to "content-first": early success relied on formulaic thrill points, but now requires cultural depth and positive values. Second, from "single-point breakthroughs" to "ecosystem building": filming bases alone are no longer enough; a full chain covering creation, production, distribution, and derivatives is needed. Third, from "domestic competition" to a "global race": overseas expansion has become a new blue ocean. From January to August 2025, total overseas revenue from micro-short dramas reached USD 1.525 billion, up 194.9% year-on-year.

Future Insights: A Diverse Ecosystem and Balanced Development

Hengdian's transformation and the rise of short-drama bases nationwide together paint a vivid picture of China's film and TV industry upgrade. The core lessons are clear. Efficiency and quality must be balanced—industrialization of short dramas is not just about speed, but about enhancing content quality and cultural value while retaining the "short, fast, and punchy" advantage. Hengdian's tech upgrades, Zhengzhou's cost control, and Hangzhou's cultural-tourism integration are all attempts to find that balance. Differentiated competition is the way forward: each city must identify its unique positioning—whether cost advantage, cultural features, or technological empowerment—and build moats in niche areas. Overseas expansion is a shared opportunity: Whether in Hengdian, Zhengzhou, or Shenzhen, all are actively laying out strategies for micro-short dramas to go global. The "new cultural trio" is shifting from simple product export to model export, requiring joint industry efforts to build global capabilities. Policy guidance is crucial: from Hengdian's targeted policies to Zhengzhou's "creation capital" plan and Wangcheng's "Ten Measures of the City of Wangcheng," forward-looking and precise government support is key to healthy development.

The lights in Hengdian still shine brightly—but they are no longer the only source of illumination. In the flourishing feast of the short-drama industry, cities across China are finding their own ways to glow. The future film and television landscape will move beyond a model of "one Hengdian, all others in pilgrimage," toward a diverse ecosystem where many stars shine, each excelling in its own domain. This industry transformation, sparked by the rise of vertical-screen storytelling, will ultimately help China's film and television sector strike a more sustainable balance between speed and depth, traffic and value.