A global short-form drama boom—hereafter referred to as "mini series"—is quietly reshaping the content industry landscape across Southeast Asia. With episodes lasting just one to two minutes, tightly compressed plots, high-intensity conflicts, and rapid twists, mini series—thanks to their unparalleled addictive appeal—have spread from China to the world. Southeast Asia, with its young population, high mobile internet penetration, and diverse cultural backgrounds, is emerging as the next core battleground of this wave. In this race, Singapore—leveraging its distinctive government strategy, industrial planning, and international outlook—is seeking to transform itself from a "learner" and "participant" into a "rule shaper" and "ecosystem builder."

Strategic Choices at the Inflection Point: Singapore's "Government Boost" and "Industry Going Global"

Facing the global opportunity presented by mini series, Singapore has responded swiftly and systematically, demonstrating a clear top-down strategy.

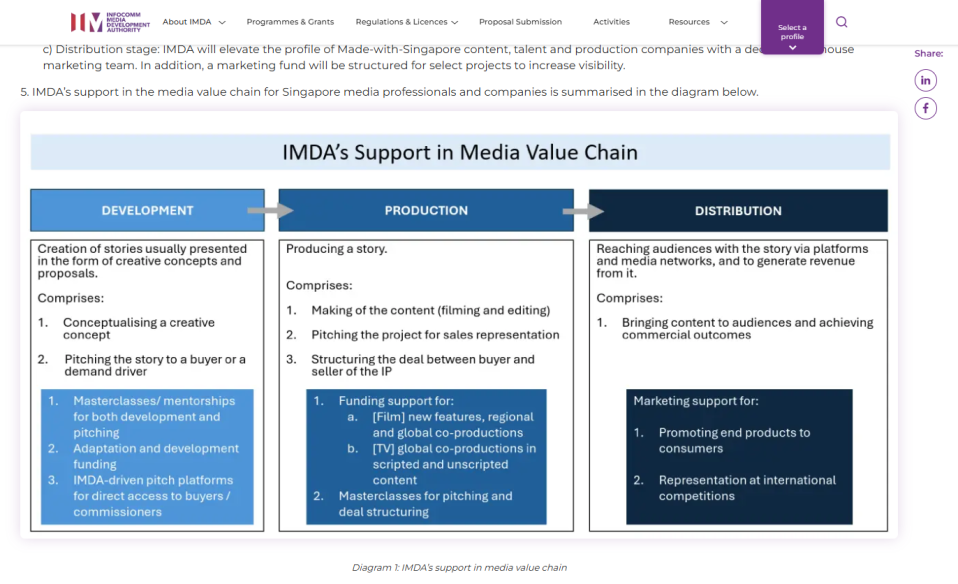

First, unprecedented policy and funding support. In December 2025, Singapore's Infocomm Media Development Authority (IMDA) announced plans to invest approximately SGD 200 million over three years to roll out the Talent Acceleration Programme (TAP), aimed at cultivating creative talent and driving the global reach of local works. This is not a simple cash handout; rather, it spans the entire industry chain—from content development and co-production to international distribution. Development stage: providing story development training and international matchmaking platforms. Production stage: co-funding regional and global co-productions, encouraging local companies to "go global by hitching a ride." Distribution stage: establishing dedicated marketing funds to professionally build the brand image of "co-created with Singapore." These measures are designed to systematically offset the limitations of a small domestic market and push Singapore's creative talent directly onto the global stage.

Capture from Singapore's Infocomm Media Development Authority (IMDA) about the TAP programme

Second, a precise focus on key tracks. IMDA has clearly identified mini series and AI technology as priority areas. Even before the market boom, Singapore had already organized producer delegations to study China's short-drama ecosystem, learning the "core logic" of industrialized and scaled production. At the same time, the government has actively promoted the application of AI tools (such as Microsoft Copilot) in content creation and emphasized upskilling practitioners to adapt to technological change. This forward-looking layout underscores Singapore's ambition to seize the intersection of new content formats and technological revolution.

Third, proactive industry "seizing an early foothold" and pragmatic exploration. Guided by policy, Singapore's industry players moved early. Companies such as Andako Education Technology Pte LTD (AET) have already plunged into China's mini series market, establishing "China–Singapore short-drama production lines" through hands-on shoots in Hengdian and elsewhere. The core of this model lies in "industry–education integration" and "experience feedback loop": On one hand, local students and performers are sent into China's mature industrial system for intensive, real-world training to quickly grasp the "traffic code." On the other hand, the ultimate goal is clearly defined as returning to local creation—using acquired methodologies to tell authentic Singapore stories set in HDB estates, hawker centers, and other everyday locales, applying what has been learned from others to strengthen oneself.

As Hu Jiawei, General Manager of COL Group, has pointed out, China currently dominates the global mini series market, while Singapore lacks strong local IPs—both a challenge and a major opportunity. Companies are seeking to build competitiveness from the source through partnerships with Chinese platforms and by launching training programs jointly with academic institutions, focusing on talent development and IP incubation.

The Southeast Asian Arena: A Diverse Landscape of Competition and Cooperation Led by Chinese Platforms

According to DataEye and similar sources, nearly all of the top ten mini series apps in Southeast Asia by downloads and revenue are Chinese platforms, such as DramaBox (Dianzhong Technology) and ShortMax (Jiuzhou Culture), which dominate with mature business models and vast content libraries. However, local forces are awakening. Thai platform TrueVisions, Singapore's Viddsee, and Indonesia's KaryaKarsa—local video platforms or creator communities—have all launched mini series sections, adapting popular local stories into dramas. The rapid rise of Indian local short-drama apps such as Viralo further demonstrates the huge potential of localized content.

TrueVisions Now app

In terms of content supply, "dubbed imports dominate, while local originals accelerate." Currently, 80–90% of content in Southeast Asia consists of localized or dubbed versions of Chinese short dramas. AI technology has significantly improved translation efficiency and reduced the cost of cultural adaptation. However, locally produced originals—thanks to stronger cultural affinity—are showing higher profit potential and growth momentum. A common production model is "Chinese supervision + local execution," where Chinese teams provide proven narrative pacing and industrial processes, while local teams handle cultural localization and on-the-ground execution. Chinese-language short dramas such as Miss Tanya filmed in Singapore and showcasing Peranakan culture, are exemplary of this collaborative exploration.

Short drama Miss Tanya

In business models, ad-supported free viewing (IAA) prevails, with active exploration of diversified monetization. Due to generally lower willingness and ability to pay across Southeast Asia (average revenue per download far below that of Europe, the U.S., Japan, and Korea), the "free content + advertising monetization" model has become mainstream. IAA and hybrid monetization (IAAP) apps are growing rapidly. Platforms are also exploring innovative models such as "mini series + telecom" (e.g., data bundles with carriers) and "mini series + e-commerce" (shop while watching) to lower consumption barriers and expand revenue streams.

Opportunities, Challenges, and the Road Ahead

The allure of a hundred-billion-dollar market and the absence of strong local IPs offer Singapore—and Southeast Asia at large—a rare window of opportunity. Yet the path forward is far from smooth.

Challenges are multi-dimensional:

Industrial foundation and talent gaps: mini series may be "short," but being "short and refined" demands highly specialized talent. From scriptwriting and fast-paced shooting to precise traffic acquisition, the entire chain requires professional support. Most Southeast Asian local production teams are still at an early stage, with insufficient talent reserves as a core bottleneck.

Policy implementation and mechanism optimization: Singapore's massive support programs are encouraging, but the industry still has concerns about transparency, flexibility, and evaluation mechanisms in the application process. How to prevent policy dividends from being diluted during implementation—and how to efficiently retain and attract production capacity—remains a key issue for ongoing policy refinement.

Homogenized competition and copyright risks: The market is currently flooded with formulaic "CEO romances" and "underdog revenge" stories. Rough, copy-paste production squeezes out high-quality content and risks creating a low-end stereotype. Meanwhile, cross-border copyright infringement (such as AI face-swapping "secondary creations") is becoming increasingly prominent, with rights protection proving difficult—posing a serious obstacle to healthy industry development.

Breaking through in the future hinges on differentiation and ecosystem building:

Creating differentiated "local labels": Singapore and Southeast Asian countries' greatest advantage lies in their multicultural melting-pot nature. Future competitiveness will not come from simply copying China's feel-good drama formulas, but from mining unique local stories—be it the warmth of HDB neighborhood life in Singapore, Malaysia's multi-ethnic comedies, Thailand's supernatural folklore, or Indonesia's contemporary urban parables. Combining universal storytelling techniques with localized cultural cores is the only way to generate real resonance and competitiveness.

Building a sustainable industry ecosystem: Moving from "policy-driven" to "industry-driven" growth requires a complete ecosystem loop—from talent education (such as China–Singapore collaborative, hands-on training), IP incubation, and co-production, to local platforms/channels and diversified monetization. Encouraging more "bridge" companies like AET, as well as deeply invested international players like COL Group, to act as industry catalysts will be crucial.

Embracing technology while regulating development: While actively leveraging AI and other tools to reduce costs, boost efficiency, and innovate content forms, the industry must also establish self-regulation and cross-border copyright protection mechanisms to safeguard original works and avoid descending into low-quality internal competition and legal disputes.

Conclusion

The rise of mini series in Southeast Asia is no longer merely a shift in content consumption habits; it is a profound signal of industrial transformation. For Singapore, this represents a strategic opportunity to leverage its international advantages, policy execution capability, and capital strength to reposition itself within the global content value chain. It is attempting to chart a distinctive path: training through China's industrial system, feeding back into local creative incubation, and ultimately exporting differentiated content to the global market.

Across Southeast Asia, meanwhile, a vibrant drama of competition and cooperation is unfolding—led by Chinese platforms and energized by the emergence of local forces. In the end, the winners of this hundred-billion-dollar race will not merely be those chasing fast capital returns, but the long-term players who truly understand local rhythms, respect cultural diversity, and build healthy, sustainable ecosystems. Singapore's advance is a key chapter in this grand narrative—one whose successes and setbacks will offer a crucial "Singapore case study" for the future of the region's content industry.